International credit rating agency Fitch Ratings has affirmed Israel's Long-term foreign and local currency Issuer Default Ratings (IDR) at 'A' and 'A+', respectively.

The Outlooks are Stable. The issue ratings on Israel's senior unsecured foreign and local currency bonds have also been affirmed at 'A' and 'A+', respectively. The Country Ceiling has been affirmed at 'AA-' and the Short-term foreign currency IDR at 'F1'.

The affirmation reflects the following key rating drivers: The central government deficit narrowed to 2.8% of GDP in 2014, the lowest since 2008 and compared with an official projection of 3.2% of GDP at the end of 3Q14. This reflected under-execution of capital spending and a jump in revenues in 4Q14. A budget for 2015/16 may not be in place until 4Q15, allowing time for the new government, formed in May, to formulate its fiscal plans.

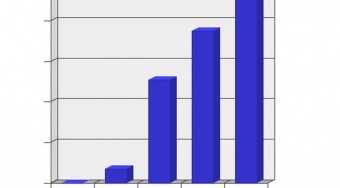

In the absence of a budget, a fiscal rule will keep spending unchanged in real terms, allowing a further narrowing of the deficit. Early indications from the new coalition suggest a more expansionary fiscal stance in 2016. Government debt is fairly high, but on a gradual downward trend at 67.1% of GDP at end-2014. A further fall is expected during the forecast period, but debt/GDP will remain above the peer median of 47%.

Financing flexibility is high, with deep and liquid local markets, access to international capital markets and an active diaspora bond programme and US government guarantees in the event of market disruption. The structure of debt is favorable.

The external balance sheet is a strength and Fitch forecasts it will improve. Gas production should ensure sustained current account surpluses, which we forecast to average just over 3% of GDP over 2015-2016. Likely large inflows of FDI will further bolster reserves and its net creditor position, which Fitch estimates at 33.1% of GDP at end-2014, compared with the 'A' range median of 14% of GDP.

Growth is stronger and less volatile than peers despite occasional conflict-related fluctuations. Real GDP growth rebounded to 6.8% in 4Q14, at quarterly annualised rates, after military operations in Gaza pulled it down to 0.2% in 3Q14. Shekel weakness, expansionary monetary policy, higher investment, a stronger global economy and a rebound from the Gaza conflict are forecast to underpin growth of 3.4% in 2015.

Inflation is currently negative, but looks set to return to within the authorities' preferred range of 1%-3% by the end of 2015 due to currency depreciation and a pick-up in economic activity.