Israel's "A" credit rating was affirmed on Friday by international rating agency Fitch Ratings, which cited Israel's fiscal consolidation and narrowing of budget deficits as giving the economy a positive outlook.

A statement by the agency said, "Debt is relatively high, at 67.4% of GDP at end-2013 compared with the 'A' median of 52.3% of GDP, but it is forecast to stay on a downward trend."

Fitch Ratings has affirmed Israel's long-term foreign and local currency Issuer Default Ratings at A and A+ respectively.

The issue ratings on Israel's senior unsecured foreign and local currency bonds have also been affirmed at A and A+ respectively. Fitch also noted, "The start of gas production has caused a structural improvement in the balance of payments that will support continued current account surpluses, which are forecast to average 2.6% of GDP over 2014 and 2015."

It also forecast "Rising global demand should support export growth despite the impact of currency appreciation, and investment should benefit from greater housing construction."

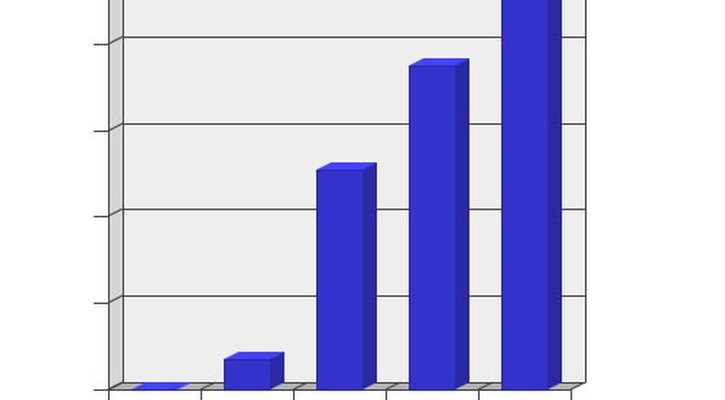

Fiscal consolidation remains on track. The central government deficit narrowed to 3.2% of GDP in 2013 compared with a budgeted 4.3% of GDP and a 2012 deficit of 3.9% of GDP, due to tightening measures and various one-off factors. Revenue strength resulted in a small surplus in Q1/14, compared with a deficit of 0.5% of GDP in Q1/13.

Political commitment to consolidation appears strong and a fiscal rule has been tightened. Fitch forecasts a further narrowing of the central government deficit to 2.5% of GDP in 2015.